Gone are the days of collecting cash and maintaining paper records of transactions. Online retail is the new buzzword in the global marketplace and payment gateways are replacing these old-school ways of making payments.

Table of Contents

Everything is online. And accessible. Credit cards, debit cards, net-banking, e-wallets etc. are ensuring a safe and convenient way making more and more customers eager to buy from the web. Payment gateways are making this easier every day.

But first, what are payment gateways?

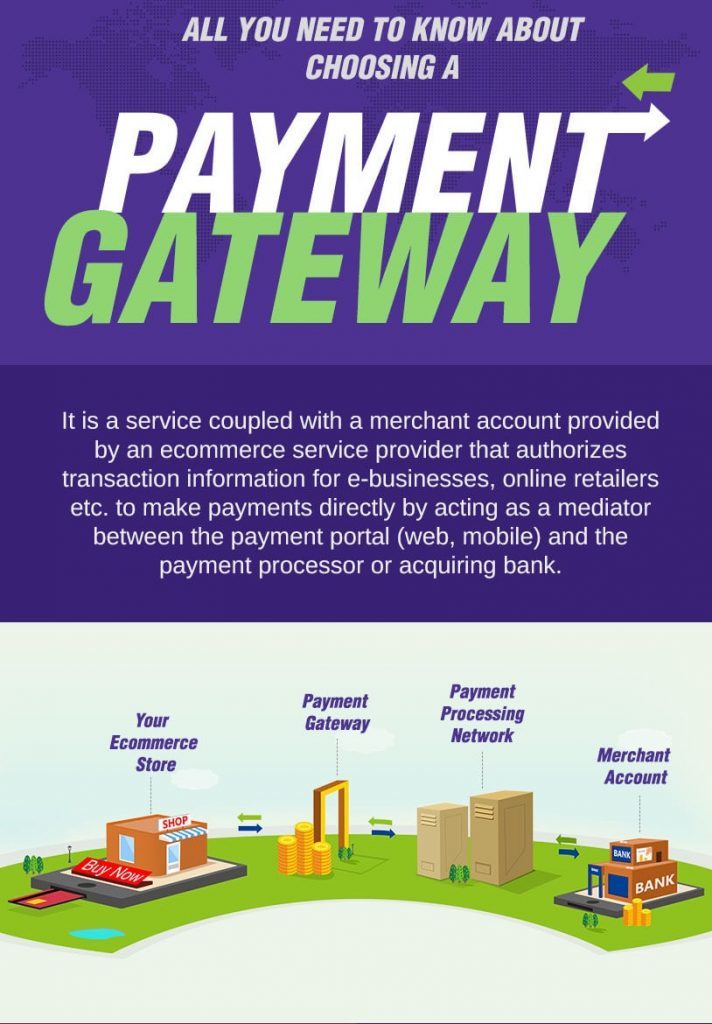

Simply put, a payment gateway is a service that connects an online store to a bank or payment processor by validating the transaction credentials through web/mobile to make a payment.

Payment Gateways thus play a substantially important role in the customer buying decision and converting customers into a sale.

A possibility of the best e-commerce businesses to fail in providing a seamless UX from cart to checkout may exist. They may miss out on providing popular payment methods to choose from. This forms one of the major reasons why customers cancel a purchase.

As per Baymard Institute’s stats – The average shopping cart abandonment rate is around 68.81%, out of which 27% is attributed to a bad checkout process and 8% due to lesser number of payment methods.

This clearly emphasizes the need to choose the right payment gateways for your store.

How to identify the right payment method?

Take baby steps to understand the business need, the comparison metrics, country-wide and currency support well before concluding your choice.

This infographic makes it easier for online business entrepreneurs, retail owners, and other mainstream online businesses to converge on a decision based on certain variables that are essential to measuring for choosing the most suitable payment gateway.

Considering the pros and cons of a gateway type is the first major step in this direction.

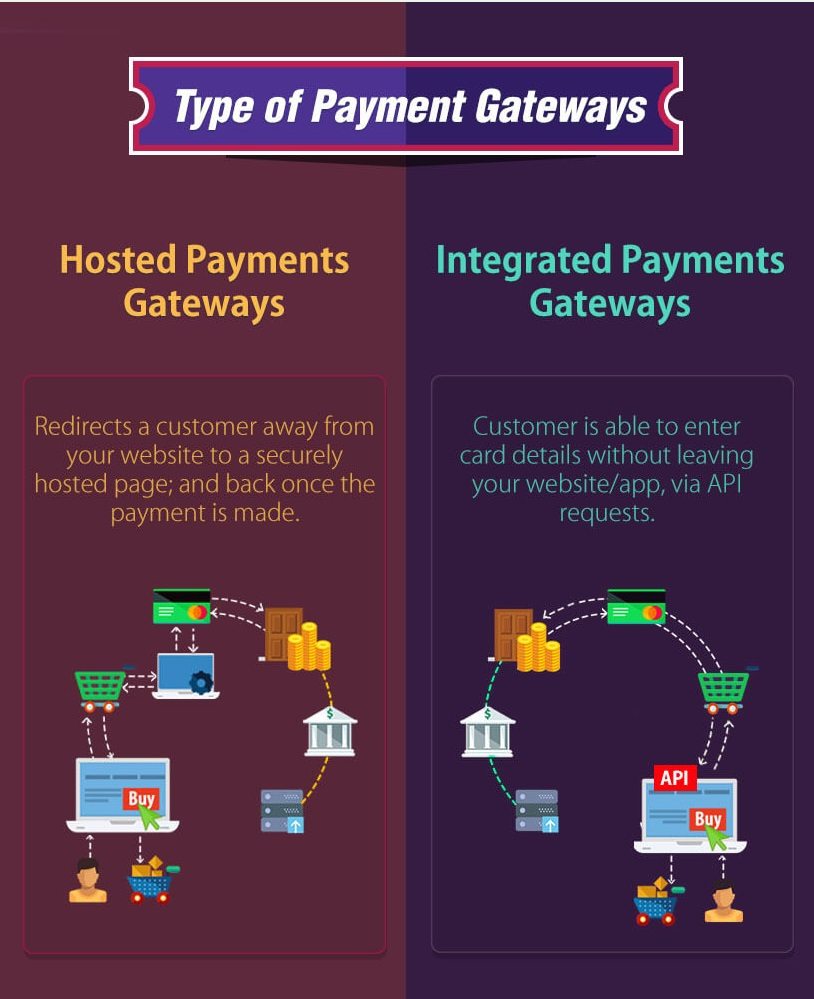

Types of payment gateways

There are mainly two types of payment gateways:

1. Hosted payment gateways

They redirect the customer to the payment service provider’s platform (host network) to input the payment information. PayPal and 2Checkout are the popular hosted payment gateways everyone is familiar with.

Pros:

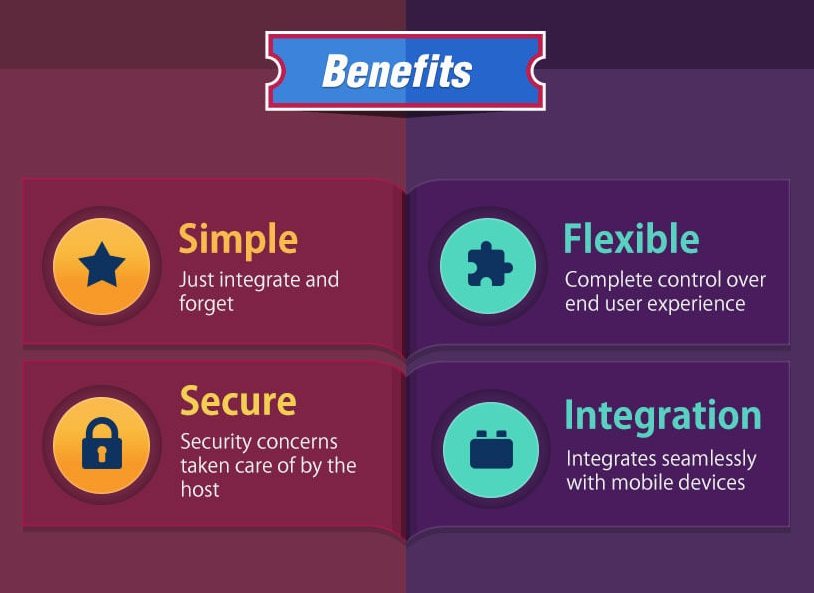

- No Security Responsibility: The biggest benefit of such gateways is that the host network or the offsite service provider takes care of the PCI compliance and security issues.

- No Set Up Hassles: Set up is the sole responsibility of the Payment Service Providers. So, there is no need to worry about the know-how to integrate.

However, in certain countries, these gateways are not preferred, while in others they are.

Cons:

- No Control Over UX: Such payment solutions often fail to impress customers with slow and complicated user interfaces. This, in turn, can have a major impact on the conversion rates of your business.

2. Integrated payment gateways

An integrated payment gateway connects your eCommerce store to the gateway services via an API. Payment Gateway providers like Stripe, Authorize.net facilitate such API calls to make direct payments through your online store.

These are also referred to as Non-Hosted Payment Gateways.

Pros:

- Smooth & Seamless Payment Experience: Since prospective buyers are not redirected outside the store site, these gateways always win the battle of providing better user experience.

- Mobile Friendly: They are fast in request and response handling, thus favoring the mobile frenzy buying population.

On the flipside, these payment gateways have their own set of disadvantages.

Cons:

- Security Responsibility: PCI DSS Compliance and SSL Certification is primarily in your hands. One security breach and your store must face the risk of an overall audit.

- Custom Integration & Maintenance: Your store architecture may not be supporting certain features provided by the gateway provider. Some custom development and ongoing maintenance cannot be ruled out on integrating such gateway APIs.

Once, you decide which payment gateway type best suits your store design and sales funnel, comes the next step.

6 Questions to ask yourself before setting up a Payment Gateway

Brainstorm this set of 6 vital questions before getting onboard with a gateway service provider for your e-commerce store:

1. What is the business need of having a specific payment gateway for my customers?

Identify your business requirements. What impact does a payment gateway have on your audience? Does it support multiple currencies? Or, what is its policy of recurring payments? Are its services available in the country where your target customers live?

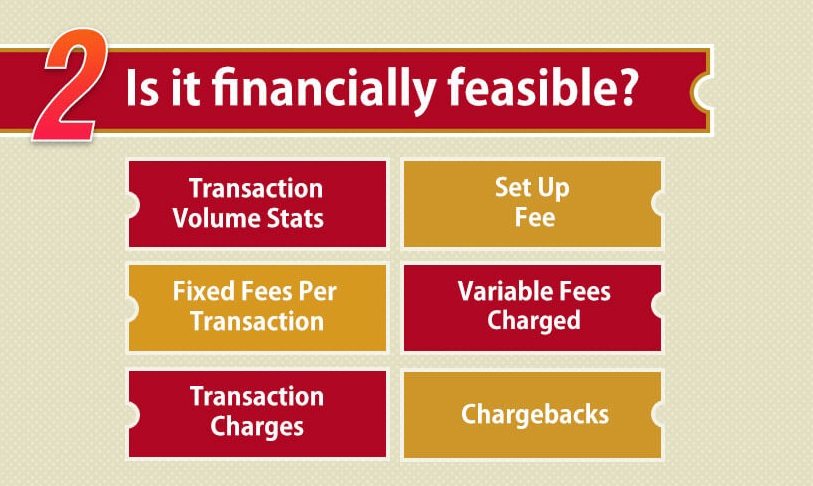

2. What is the financial feasibility in opting for a payment gateway?

Make sure the setup fee is not high and the fixed fee per transaction is not costing you much. Some gateway providers charge a variable fee. It is important to understand the overall fee structure charged by the service providers so that it is not impacting your business financially. You should also know which payment gateway is best suitable for preventing charge-back frauds for your online business.

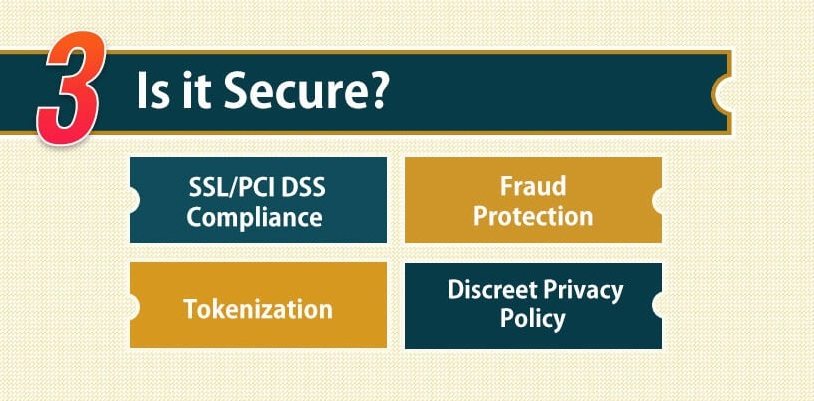

3. How secure is the payment gateway to make online payments?

A secure payment gateway is of utmost importance for your customers to make a purchase and if you want to retarget the existing ones. A gateway provider should have a complete privacy policy and offer level 1 compliance with Payment Card Industry Data Security Standard (PCI DSS).

The SSL certification of the provider builds a trustworthy image of your store for the customers. They should also handle fraud protection and support various tokenization techniques to prevent any security breach.

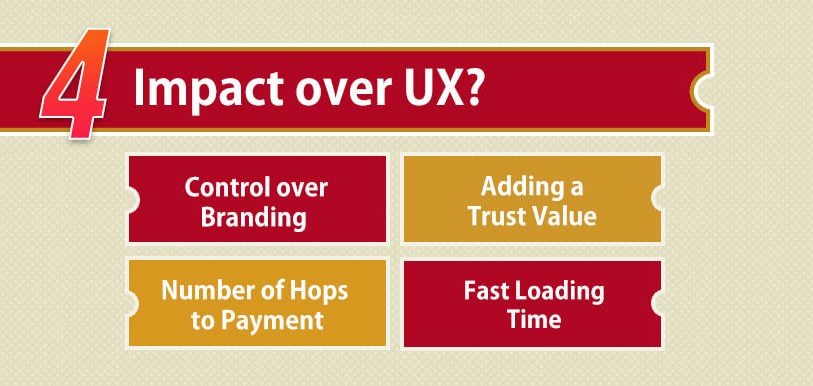

4. How does it affect the user interface of your existing store?

Multiple screens and increased number of hops are a big no for user experience. There should be minimal effect on the design and structure of your web store. Also, calculate the design impact on mobile platforms so that it is easier to integrate when you plan to take your store to mobile. The sooner, the better though.

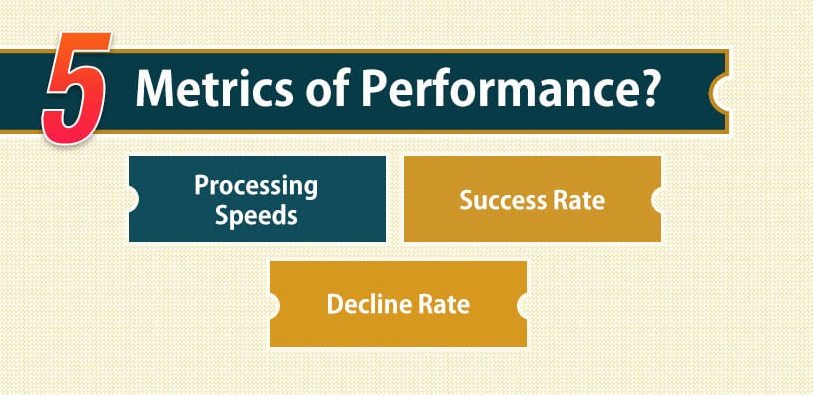

5. How well does the payment gateway perform in real time?

If in real time, your payment gateway is declining more transactions and still making a sale, it is a cause of concern. Measure the essential performance metrics such as speeds, decline rates and success rates for instance, which Spreedly provides, to compare the suitability and the impact on your business.

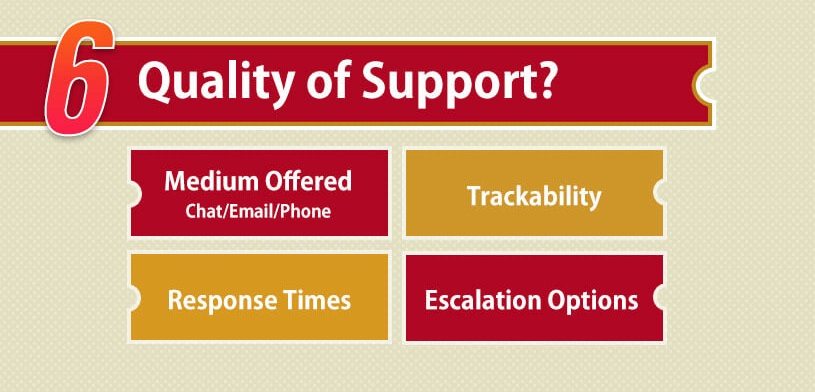

6. How good is the support system of the payment gateway provider?

In case you land up having issues regarding a disputed transaction or to file a complaint, how well reachable is the support team? Their response time and issue tracking management highlights their credibility in the market. So, make sure their support services are quick and smooth.

Once you have prepared a list of these questions, it’s time to know which gateways rule the market and are a best fit to answer your questions.

What Payment Gateway options do I have?

Here’s a list of the top 10 payment gateways the dominate US market:

- Paypal

- Stripe

- Braintree

- WorldPay

- Authorize.net

- WePay

- 2Checkout

- Beanstream

- FirstData

- Payline Data

Comparison between the top 5 payment gateways

This infographic compares the best online payment gateway providers to help you with the latest information on the country, currency, payment method support and enlists the setup and transaction fee for each.

This data clearly indicates that PayPal is enjoying a majority with a plethora of service offerings and worldwide support.

While Braintree, also a PayPal company, is laying its hands on the mobile market with the new Apple Pay, Android Pay mobile payment support.

Stripe has recently joined the league of blockchain by enhancing its support for accepting instant bitcoin transactions -an upcoming trend in the future of payments.

One last step in the right direction

Nevertheless, popularity and support is one aspect of this decision-making process while management is another. So, before taking the last step, be well informed of the extra steps your payment gateway takes to ensure your store does not face data leaks, ID thefts, technical breakdowns and payment holding on a consistent basis.

The below infographic is designed by Kays Harbor keeping in mind that the payments industry is experiencing its peak in innovation and will impact online businesses on a large scale.

Which payment gateway do you think is the best? Did we miss your favorite? Tell us below or tweet us!