In 2016, worldwide m-commerce trends took on a new dynamic: mobile search overtook search on desktop for the first time. The International Post Corporation (IPC) has recently completed a survey of over 24,000 online consumers, based in 26 countries spread across Europe, Asia-Pacific and North America. This study provides the most important worldwide m-commerce trends, as well as cross-border purchase and logistics trends for 2016.

Worldwide M-Commerce Trends: The Rise of smartphone use for online shopping

A key trend in online shopping in recent years has been the increasing use of Smartphones for both researching and carrying out online purchases.

Smartphones are key to the lifestyles of younger consumers, who often use their phone as their primary method to access the internet. Furthermore, in many emerging markets and developing countries, the smartphone is the first device that consumers are able to use to access the internet – they never owned a PC!

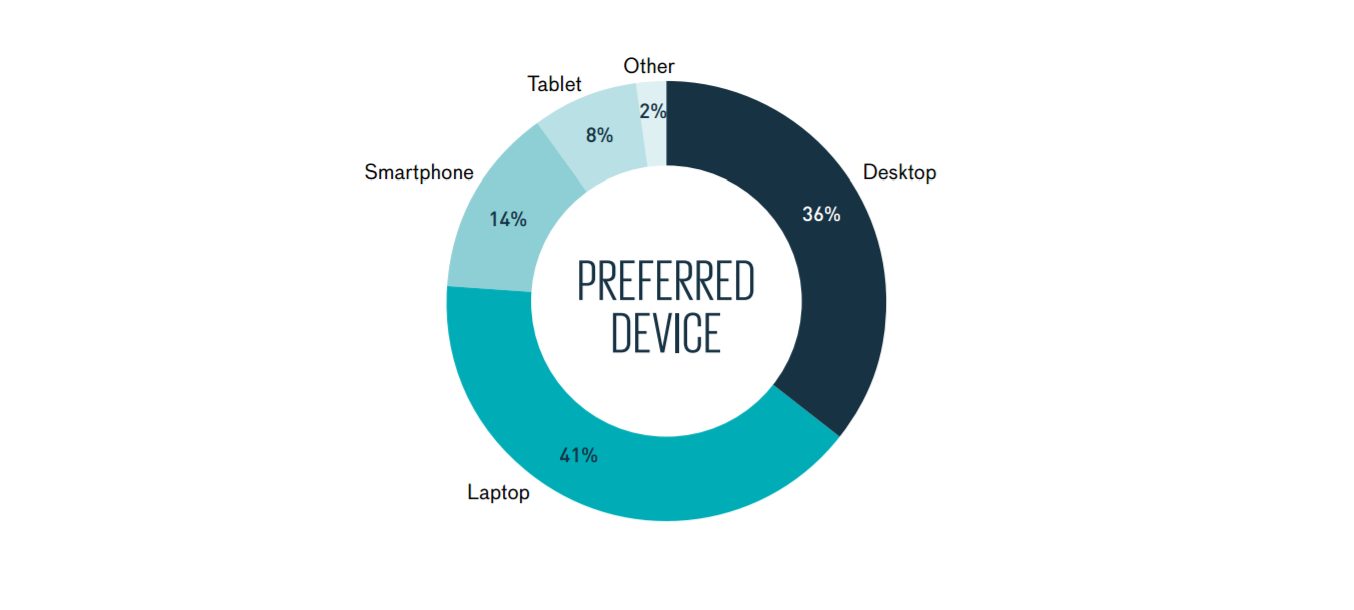

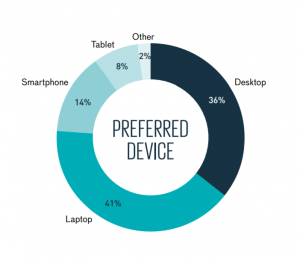

The IPC e-commerce Cross-border Shopper Survey asked consumers what their preferred device was to place an online order, in order to assess the relative level of importance of Smartphones. The most popular device was still a laptop (41%), closely followed by a desktop (36%). Smartphones (14%) and tablets (8%) were the preferred device for a significant proportion of the population.

Compared to IPC’s 2015 survey, the biggest change has been that Smartphone preference increased from 9% in 2015 to 14% in 2016.

Desktops were most popular in Portugal (55%) and France (53%), and least popular in Iceland (16%) and Ireland (20%). They were also more preferred by consumers aged 55 and above (45%).

Laptops were most popular in Iceland (55%), Ireland (53%), Norway (49%) and Finland (48%). They were less preferred in China (23%) and Portugal (24%). They were preferred more by women than men, with no age difference.

Tablets were the least popular option, though still used by a sizeable proportion of consumers in Denmark (14%), the UK and Ireland (both 12%). They were most popular among 35-54 year-olds (9%).

Smartphones were most preferred in China (29%), Japan (27%) and the US (26%) – but less so in Belgium (6%) and France (7%). They were preferred by 23% of consumers aged 16-34, 13% aged 35-54 and 5% aged 55+.

While for the moment, PCs and Laptops are the most popular for purchasing, many consumers are still starting their search or looking for product information via mobile. While customers might be less inclined to purchase via their mobiles (for a multitude of reasons), it’s important to make sure that your site is optimised for mobile to best respond to your omnichannel customers.

The importance of parcel tracking

A key focus of the study – and of IPC’s role in general – was to explore consumer attitudes towards and experiences of parcel tracking, especially when buying parcels cross-border.

Consumers placed a very high level of importance on parcel tracking at all stages of the parcel journey: from send-out by the seller, to ‘parcel has arrived in your country’, to ‘parcel is in customs’, to ‘parcel is on its way to your home’, and finally confirmation that the parcel was delivered.

Respondents to our survey placed even more importance on parcel visibility than on speed of delivery.

When asked about their most recent cross-border online purchase, 69% of consumers were offered the opportunity to track their delivery status, 24% were not offered parcel tracking, and 15% could not remember whether or not they were offered this.

- Tracking was offered most often for cross-border e-commerce consumers based in China (83%), followed by those based in Italy (74%) and Spain (73%).

- It was least likely to be offered to cross-border e-commerce consumers based in the UK (42%), Norway (47%) and Australia (48%).

Customers had more trust in cross-border e-commerce stores that allowed for tracking at each step of their purchase’s journey: and an even better point- if they could track their parcels via mobile.

Parcel tracking via mobile applications

When asked for their preferred channel for receiving information on the status of their parcel delivery, 75% of respondents preferred to be kept updated via e-mail, 17% via SMS and 6% via mobile applications.

Preference for parcel tracking via mobile applications was highest in China (27%), but is still rather low in most other countries.

One notable finding is that women are more likely than men to use their mobile for online shopping, but men are more likely than women to use an App to track their parcel. Therefore, webshops should take this into account when offering a website and parcel tracking service that is equally accessible for all consumer types.

These findings are a selection of results from the IPC Cross-border e-commerce Shopper Survey 2016. The sample size for the survey was 24,331 interviews in 26 different countries.

The research took place using online consumer panels supplied by Qualtrics between 29 September and 24 October 2016. In order to be eligible to take part in the survey, respondents had to have bought a product online – whether domestically or cross-border – within the past three months. Those who shopped online less regularly were excluded from the worldwide m-commerce trends survey sample.

The m-commerce trend has been predicted for years. And it’s now developing more than ever. Due to the rise of technological progress and Google including the “mobile friendly” options as a criteria in its SEO. If you’re interested in m-commerce and want to know more to see the full report, please click here.